Microgrids After 2025: How Solar and Battery Storage Are Reshaping Business Energy Strategy in 2026

DOWNLOAD THE 2026 REPORT

Click here to get your copy now.

Find out why more commercial and industrial facilities are pairing solar with storage to control costs, manage risk, and ensure operational continuity.

2025 in Review: A Market That Moved From Growth to Maturity

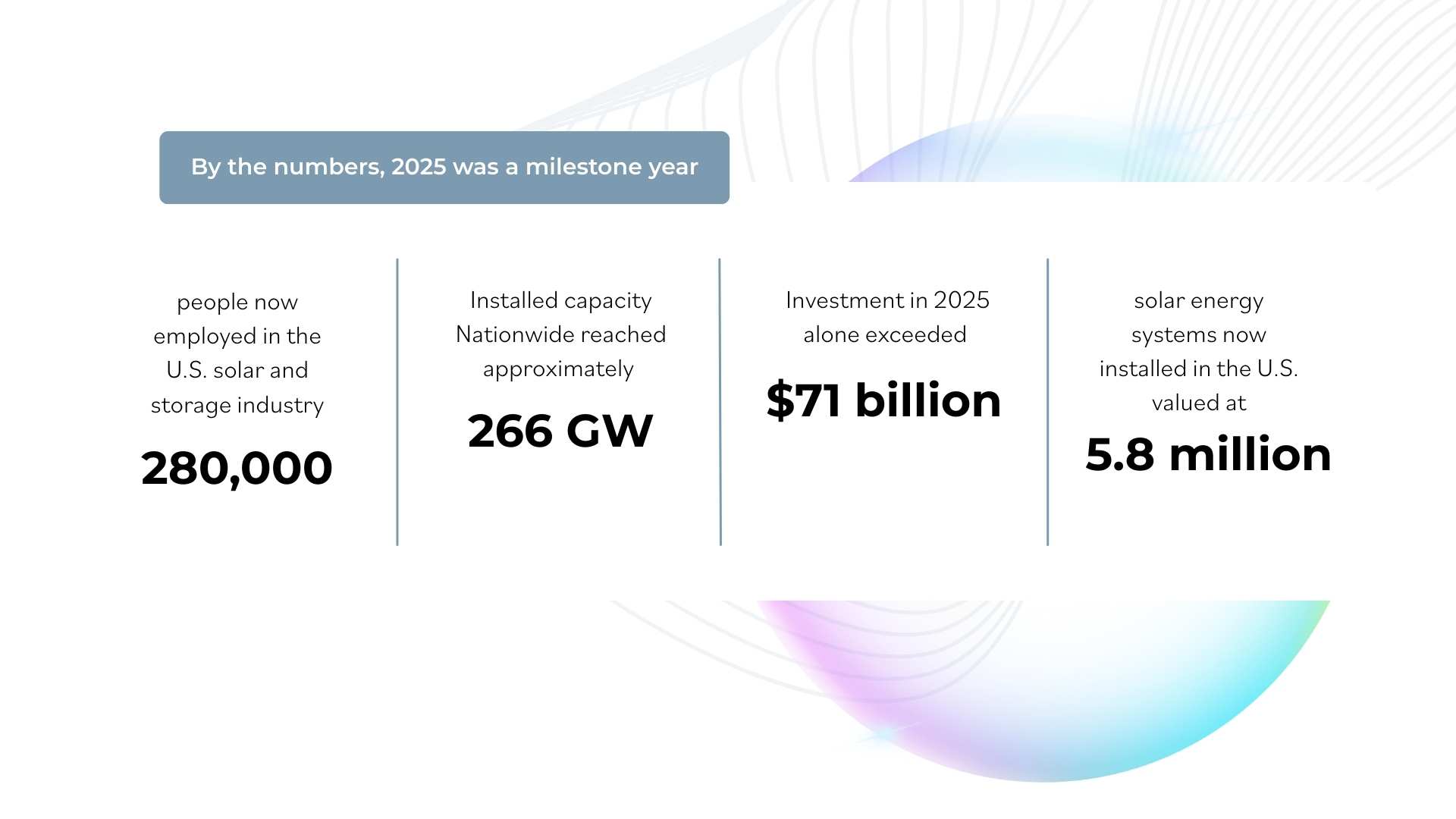

The past year has been a defining one for solar, energy storage, and distributed energy systems across the U.S., particularly in California. What was once considered mostly an environmental initiative is now being treated as core strategic infrastructure, shaping how businesses, especially commercial and industrial (C&I) facilities, plan capital investments, manage operating costs, and meet complex regulatory and reliability expectations. Looking back at 2025, several themes are clear: scale accelerated, storage became vital rather than optional, and solar solidified its role as an economic decision, not just an environmental one. These forces are evolving into new trends that leaders should be prepared to navigate in 2026.

Over 72 percent of planned grid additions through 2030 are solar, storage, or microgrid systems, showing how central these technologies have become to national energy planning. Solar and storage are no longer alternative energy; they are the backbone of modern energy infrastructure.

Storage also reached a major milestone:

- The U.S. now has over 104 GW of utility-scale battery capacity, serving industrial parks, campuses, and large energy users

- Commercial + industrial solar + storage capacity grew faster than residential in 2025, reflecting demand for demand-charge management and resilience

- Adoption of microgrids and hybrid energy systems expanded across campuses, manufacturing sites, critical facilities, and campuses with California leading deployment due to resilience requirements

- Manufacturing capacity for solar modules reached 64.8 GW, more than six times the growth seen two years ago, improving supply reliability for business-scale projects

For business and institutional energy users, 2025 wasn’t just about scale, it was about operational impact.

Commercial and industrial facilities increasingly paired solar with storage not only to reduce energy costs, but to manage peak demand charges, support resilience plans, and ensure continuity during grid disturbances.

In California’s challenging grid environment, microgrids and hybrid solar + storage systems moved from pilot projects into mainstream deployment, with facilities including campuses, industrial parks, and critical infrastructure leading adoption.

California’s Role: A Leader and a Learning Lab

California remains the nation’s largest solar market, with more installed capacity than any other state. Its significance goes beyond volume. The state is:

- A test bed for utility rate reform

- A leader in NEM/NBTD policy shifts

- Driving building electrification, microgrid adoption, and load flexibility

- Increasingly incentivizing energy storage as part of system design

Projects in California over the past year have addressed peak pricing dynamics, interconnection complexity, wildfire resilience, grid reliability, local permitting nuances, and corporate ESG priorities.

This has reinforced a key reality for 2026: solar alone is no longer the solution. The combination of solar, storage, smart controls, and microgrid design is becoming standard practice.

What Changed in 2025 That Buyers Should Pay Attention To

Based on our work with facility owners, developers, and operators, five shifts stood out:

- Energy is now a board-level decision. CFOs and CEOs are increasingly involved in solar, storage, and microgrid planning, not just facility teams.

- Resilience became operational necessity. Weather events, PSPS shutoffs, and grid constraints made many projects central to business continuity strategies.

- Procurement conversations became more sophisticated. Buyers now ask about lifecycle costs, upgrade paths, modularity, serviceability, and microgrid integration, going well beyond price-per-watt.

- Policy incentives became tangible. ITC, Inflation Reduction Act credits, and bonus incentives are now applied in active projects, not just on paper.

- Domestic supply growth shifted the conversation from availability to performance. With more U.S. manufacturers now producing modules, batteries, and balance-of-system components, the question is no longer simply whether equipment can be sourced. The real differentiator in 2026 will be how well systems are designed, integrated, and supported across their lifecycle, particularly for commercial facilities and industrial microgrids where operational continuity matters.

2026 Outlook: Five Trends That Will Shape the Year Ahead

- Solar plus storage microgrids as the standard design

Systems integration is becoming the norm due to peak-shaving economics, demand charge management, backup power, and resiliency applications. Storage adoption is expected to grow significantly in commercial, industrial, and public sectors as early leaders demonstrate success to a growing audience - Focus on total project performance

Buyers evaluate uptime, system integration, software and controls, service and support, and expandability for future load growth such as EVs and process electrification. Holistic design engineering is increasingly preferred over hardware installation alone. - Creative financing and deal structuring

Transferable incentives, PPA variations, and tax credit adders will expand third-party ownership models, municipal and education sector access, and mid-market business participation. - EV infrastructure and solar integration

As fleets electrify and charging infrastructure expands, solar plus storage supports load management, peak demand reduction, and facility planning. - California will continue to lead

Policy updates, grid modernization, and climate-driven resilience will keep California at the forefront, influencing the adoption of microgrid-enabled C&I solar projects nationwide.

Implications for Executives and Decision-Makers

Facility owners, developers, and operators should consider:

• Exposure to rate volatility and demand charges

• Integration of resilience into risk management strategies

• Planning for future load growth, EVs, and electrification

• Sites where storage or microgrid integration could improve project economics

• Capturing ITC and other solar incentives still available to commercial and industrial projects

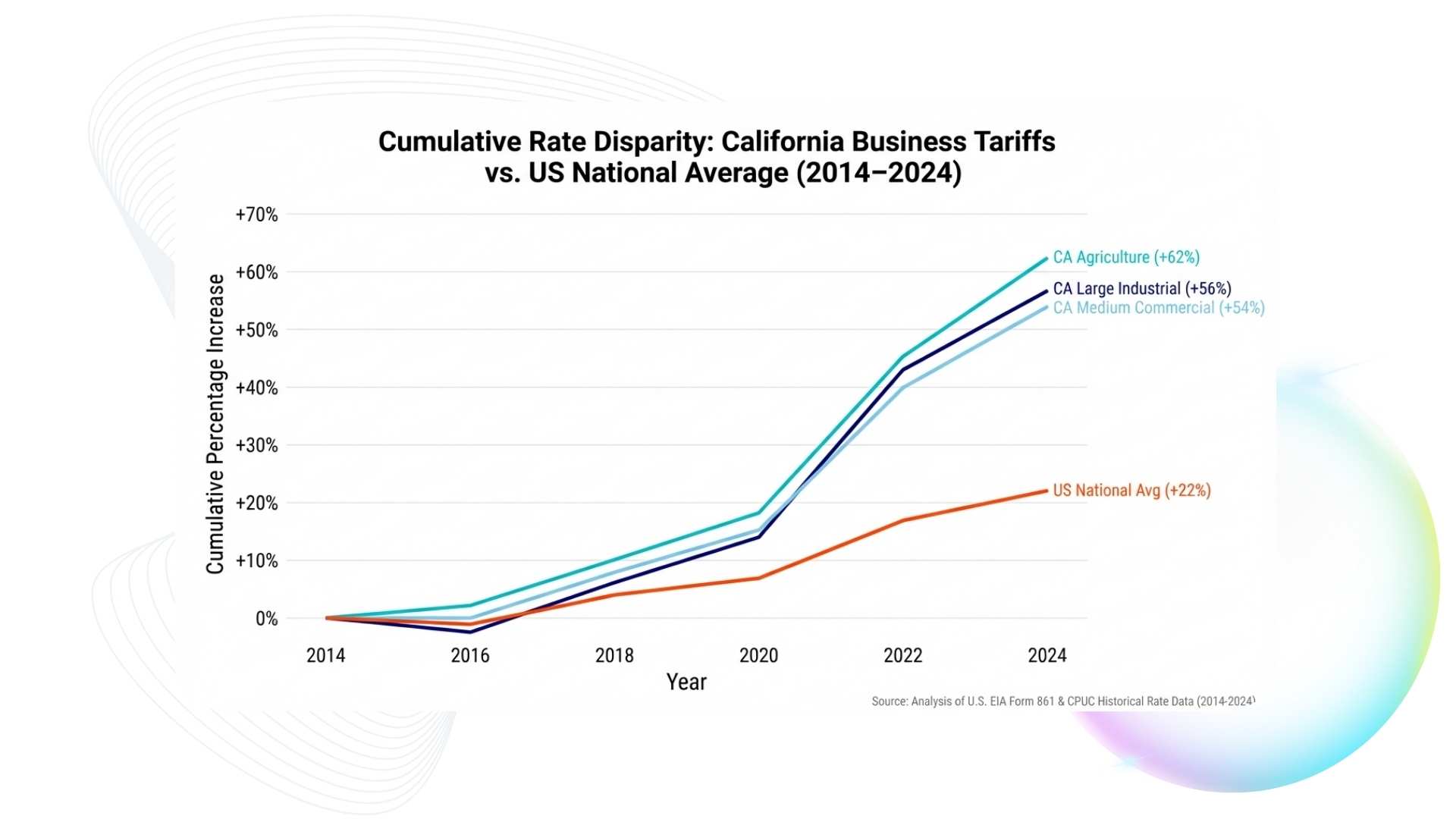

The most successful organizations approach solar and storage not simply as energy purchases, but as strategic infrastructure investments. As the chart above illustrates, electricity rates for commercial and industrial customers have steadily increased over the past decade, reinforcing the value of proactively managing energy costs. By integrating solar and storage into long-term planning, businesses can not only hedge against rising rates but also enhance resilience, optimize operations, and position themselves for future growth in an evolving energy landscape.

Talk To Us